- The Growth Loop

- Posts

- How Mokobara Grows 🪴

How Mokobara Grows 🪴

Growing with India1: Inside Mokobara’s design, distribution, and brand game

My dad had a transferable job, so every summer, we took the train to our hometown. And every year, like clockwork, my brother and I fought over who’d carry which bag on the platform.

We traveled heavy — two old-school hard-shell VIP suitcases with stitched covers (both carried by my dad), and a mix of handmade, overstuffed shoulder bags. My mom always picked the heaviest one. That left the last two for us to fight over.

Each was handstitched, bulky, and had that one pointy corner that’d jab you in the ribs with every step. Watching us board the train wasn’t a pleasant sight. We didn’t travel light, and we definitely didn’t travel in style.

But things have changed since the 90s.

Luggage isn’t just luggage anymore. It’s a part of your personality. And leading that shift is Mokobara, a 5-year-old D2C brand making legacy players sit up and rethink their playbook.

Today, we unpack how Mokobara is reshaping the way India packs, travels, and shows up.

Let’s go 👉

Table of Contents

The Indian consuming class(definition in the image below) is exploding.

In 1995, just 0.5% of Indian households fell into this category. By 2020, that number had grown to 8%. In the last 3–4 years alone, it has doubled again.

That means millions of new households now have disposable income, are brand-conscious, and are willing to pay a premium for better design, quality, and experience.

This growth is fueling a demand wave for mass premium products. High-quality, aspirational goods

And this is exactly where a new breed of D2C companies is positioning and winning. Atomberg with fans. Minimalist with skincare. BlissClub with activewear. Mokobara with travel gear. Each of them has found a way to tap into this upgraded Indian consumer — through thoughtful design, sharp positioning, and relentless focus on value.

With that overview, let’s look at what was happening in the luggage industry when Mokobara started.

The Indian luggage Industry Outlook since Mokobara’s Inception (2020-2024)

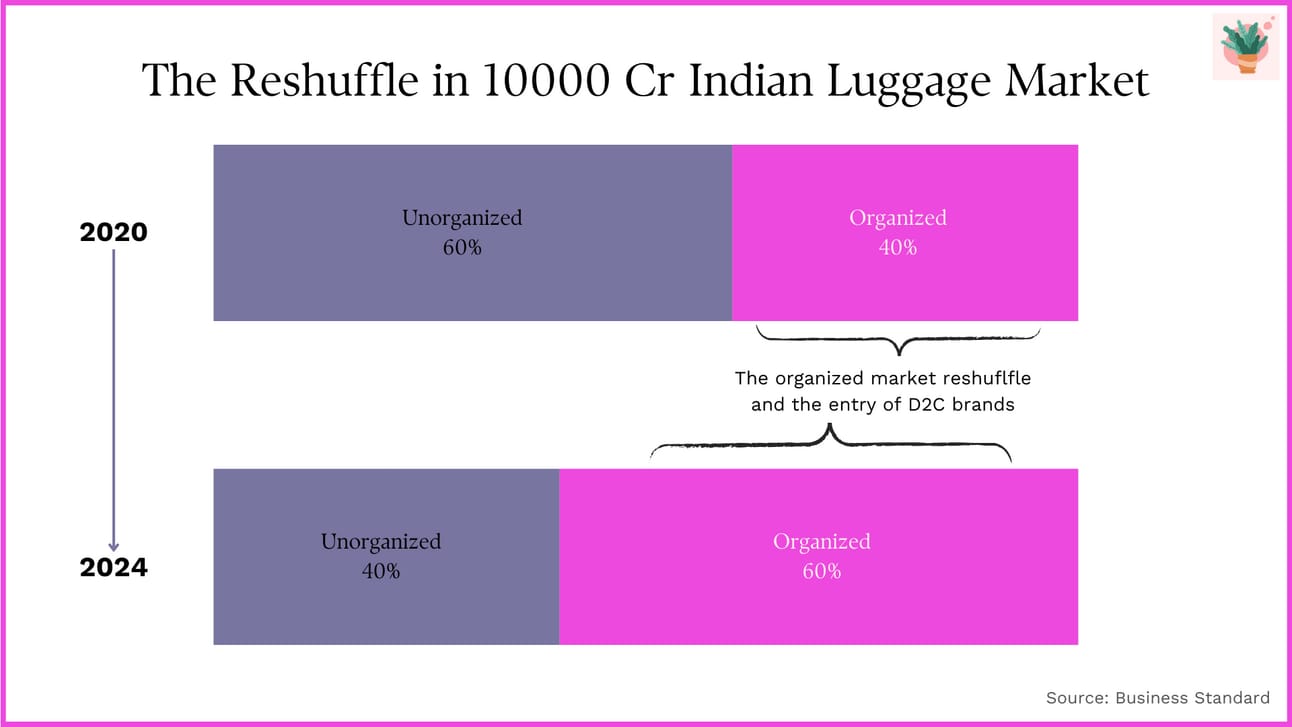

Historically, the Indian luggage market has been divided between organized and unorganized sectors. As of 2020, organized players accounted for approximately 40% of the market, while the remaining 60% was dominated by unorganized manufacturers. But post-pandemic, the equation flipped.

By 2023, the organized segment is estimated to have grown to nearly 55–60% of the total market.

Branded market is on a rise

Within the organized segment, three companies have traditionally held dominant positions - VIP, Samsonite, and Safari. Together, they contributed to 99% of the luggage market in 2020. However, this is changing, slowly. In the spurt of organized category growth between 2021 and 2024, we see a wave of digital-first brands that have started eating into the space.

While some of the upcoming brands have focussed on premium-feel luggage such as Mokobara and Assembly, brands like The Souled Store and Daily Objects are dabbling into bags and travel gear.

Here’s how Market shares have tentatively reshuffled over the years:

Brand | Market Share (2020) | Market Share (2024 est.) |

VIP Industries | ~50% | ~44% |

Samsonite | ~34% | ~30% |

Safari | ~17% | ~24% |

D2C Brands | <1% | ~2–3% (but growing fast) |

Legacy players still own a large piece of the pie, but now, they are sharing the stage with digital-first challengers. And although these D2C brands don’t own the market share yet, they surely own the conversations.

With that context, let’s get into the working of Mokobara

How Mokobara started

It all started when Sandeep, an engineer with a background at Urban Ladder and Mahindra and Mahindra, was making a small trip to Singapore. He went to buy a trolley bag and found a glaring market gap.

"On one hand, you had brands offering low-quality products at low prices. And, on the other hand, you had expensive foreign brands that would cost more than the flight ticket for your trip,"

Sandeep, a builder at heart, decided to own this problem. He decided to build a product that met the needs of consumers like him.

To shape his idea into a product, he roped in his friend Navin Parwal, a designer with work ex at Urban Ladder, Flipkart, Uber, and WeWork. As the duo dug deeper and deeper into the product-building journey, they realized that Brand has to be integral to their idea.

Their base thinking behind this was that today’s generation doesn’t really relate to the luggage brands in the market.

If you look at the India1 consumers' shoe preference journey, they have transitioned from Bata to Reebok/Nike to Onitsuka Tiger and Berkinstock, but when it comes to luggage, the choices they get are the same that they have had since childhood. They don’t like that!

Alright, let’s get back.

It took 18 months of obsessive iteration for Sangeet and Naveen to build their first product.

They didn’t rush to launch. They didn’t cut corners. Instead, they treated the first product like it had to be perfect. As the founders put it, there’s no MVP in consumer brands. You can’t launch a 90% okay product and “iterate later.” That first impression has to land.

Sandeep and Navin visited over 25–30 factories, looking for partners who could execute the way they wanted. Most couldn’t match the speed or attention to detail they needed. They eventually found one manufacturer who could collaborate closely, move fast, and communicate well — and locked in.

But design was still a challenge. Getting people to love a luggage design isn’t easy. The early prototypes didn’t wow anyone.

So, with no funding and a big vision, they made a bold call — they brought in Morrama, a London-based industrial design agency, to help craft Mokobara’s design DNA. Together, they developed a universal design language for the brand: bold but simple, aesthetic but never over-designed, functional without being boring. Nothing decorative for the sake of it. Every latch, line, and curve had a purpose.

This relentless push led to their first cabin-size suitcase. Just one product. One SKU. But it worked. It looked great, felt premium, and met a very real need.

Still, early investors were skeptical. Luggage wasn’t a repeat-purchase category. Selling high-ticket items online was seen as a tough play. And Mokobara wasn’t a low-cost volume game — it was a brand play in a market that hadn’t seen brand innovation in years.

That’s when they met Manu Chandra from Sauce.vc — one of the few early believers. His take: India is ready for a premium brand — if the design is right, the buyers will come.

And they did.

Mokobara launched on January, 2020, with just one product. That became their wedge into the market — and their foundation for everything that followed.

Next, let’s talk about design a little bit.

Luggage is well… no more luggage

If you scroll back to Instagram influencer photos from 2020-2021, you’ll notice that not many of them have their luggage photos. And if they do, it’s most likely something posh such as Louis Vuitton.

In today’s travel culture, luggage has surpassed its traditional role. It is no longer a utility but a personal style statement. People are moving from

I went on a trip ✈️ → I went on a trip in style ✈️🕺🏻

It’s not just that more people are flying; it’s how they’re doing it.

This evolution demands designs that reflect the travellers' personality and, to an extent, their identity too.

Keeping this in mind, Mokobara has positioned itself at the intersection of functionality and style. The brand's design philosophy is rooted in 'Lagom,' the Swedish principle of 'not too much, not too little.' This ethos is evident in every aspect of their products:

Attention to Detail: Mokobara incorporates Japanese hinomoto wheels for durability and smooth maneuverability on rough Indian roads. Additionally, the hard shell of their suitcases is reinforced from the inside, ensuring strength without compromising design.

Signature Elements: Mokobara bags have a distinctive zip lining on their bags designed to evoke joy

We also wanted to make sure that each design met the highest international standards when it came to quality and functionality. We wanted the journey to be as enjoyable as the destination. That's why, when you take a close look at any Mokobara - from our first Cabin Luggage design or our most recent one, you'll find that each Mokobara comes with thoughtful functionality designed to elevate the joy of travel. Whether that's through the addition of hidden pockets to secure your passport/phone on our backpacks, or the Japanese Hinomoto wheels that have their smooth signature stroll.

With a solid design foundation, Mokobara's next challenge lies in effectively bringing these products to market. Let’s delve into their messaging and Go-To-Market (GTM) strategy

How Mokobara Grows: Messaging and GTM Strategy

Mokobara’s GTM strategy isn’t built on just selling luggage — it’s about selling the feeling of going places. The brand has been deliberate in how it talks, where it shows up, and whom it partners with.

In our GTM discussion, we will cover four core segments of their growth playbook: Targeted messaging, Social Media strategy, Partnerships, and Going Omnichannel.

Pillar #1: Targeted Messaging

Mokobara leads with one line: #GoingPlaces.

It’s more than a hashtag — it’s a signal. To the urban millennial, it says this bag gets you. This brand is for people moving up, moving out, moving forward. Whether you're traveling for business or checking into a boutique hotel, #GoingPlaces wraps it all in aspiration.

The message is tight, repeatable, and travels well across ads, packaging, influencer captions, and email headers. It turns customers into brand advocates — not just for the product, but for the lifestyle.

I’ve spent 25 hours studying their Instagram strategy alone because I just couldn’t stop. Their Instagram page feels a lot like love.

Packing for a trip, GRWM, sitting at the airport, wheeling bags down a hallway, and travel shots that feel lived (not staged) - it’s like a modern art gallery. The page also feels like a right balance between polished and raw content. You get a mix of celeb posts, influencer posts, and user-generated content that blends top to down - and it works.

I’ve curated a Miro board to dive deep into this strategy. Click on the CTA below to enter the Mokoverse.

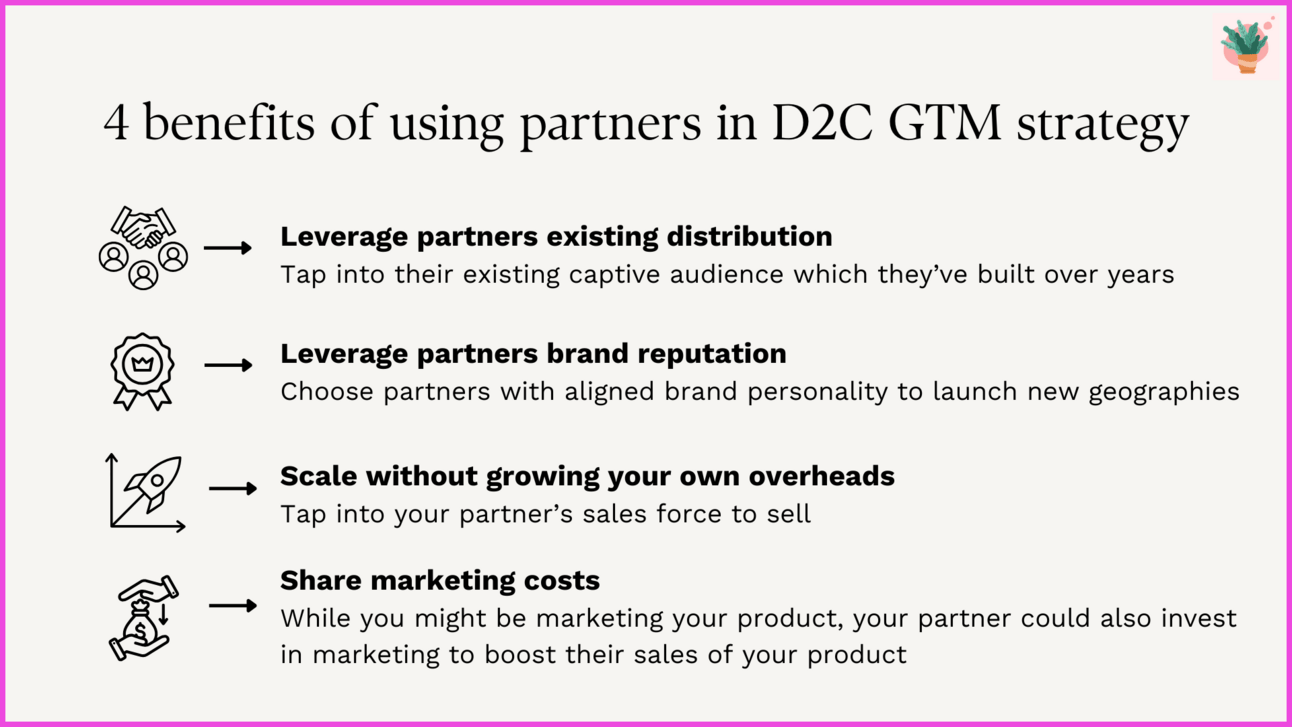

Pillar #3: Partnerships

In addition to creating effective content that people find valuable, Mokobara has been extremely successful in expanding its content’s reach and user base by partnering with some of the most relevant brands in the luggage industry.

Benefits of partnerships in GTM strategy

Indigo 6E

Mokobara teamed up with the largest Indian airline service, Indigo 6E, to create a co-branded luggage line in signature Indigo blue. What’s in it for the customers? They get 2kgs extra baggage allowance a year. That's like building a benefit that ties the brand to real travel behavior.

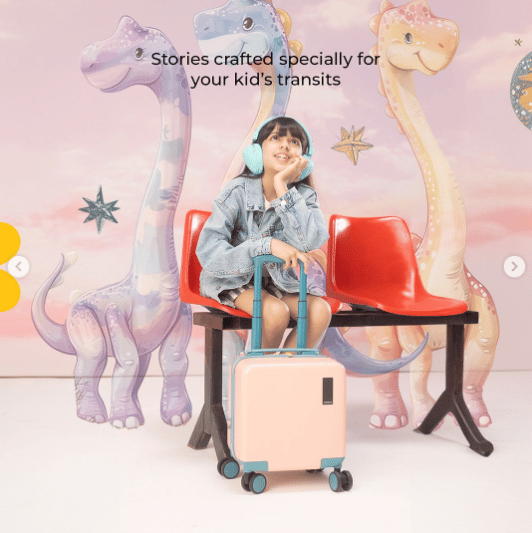

Vobble

Mokobara has also partnered with a kid’s audio storytelling company called Vobble, making the kids’ travel fun. This is a smart way to stay relevant to families and younger parents.

Look how cute the bags and headphone combo looks

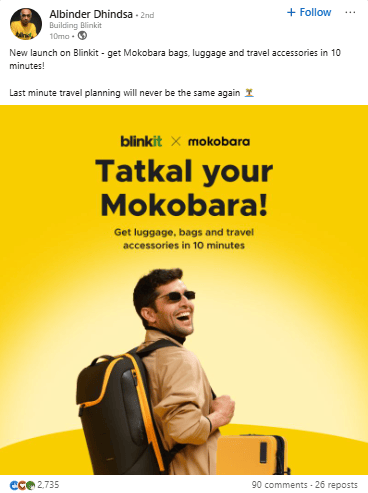

BlinkIt

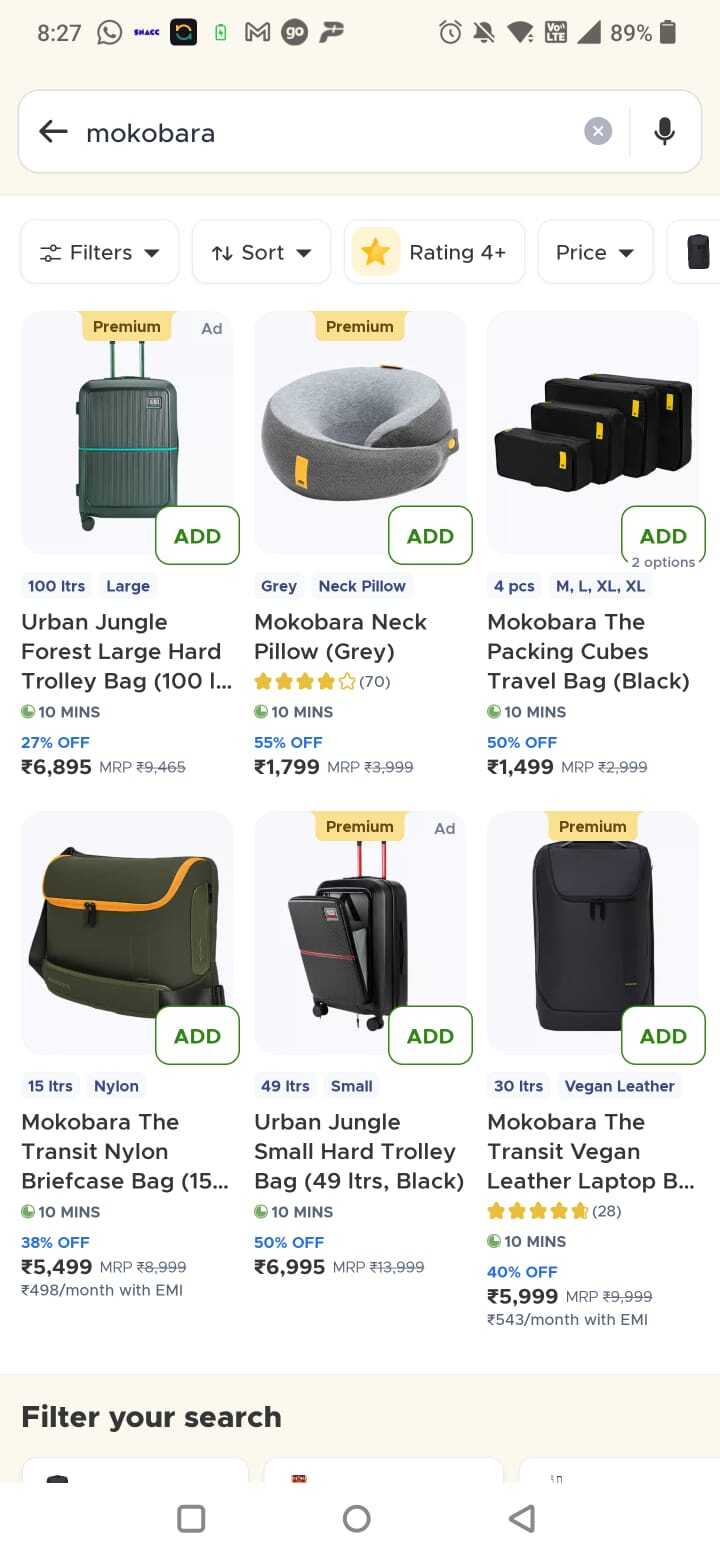

Launching on aggregators for D2C brands seems BAU. We can find most of them on Amazon and Flipkart. So why the special mention?

3 reasons

The way Mokobara and BlinkIt has launched their collaboration, is impressive. Albinder Dhindsa’s collaboration post on LinkedIn received 2.5k+ likes. Linkedin, as a platform is where Mokobara doesn’t market at all. So, just by the virtue of this post, Mokobara improved their TOFU (I’ve covered examples of launch post in the social media board).

Mokobara is the first and one of the two luggage brands on Blinkit so far. Plus, Blinkit sits right in the middle of India1 audience and is smartly shaving off their top customers from Flipkart and Amazon so far. Meaning Zero competition → 100% visibility for Mokobara

Selective, relevant and fast-moving products on BlinkIt only: Mokobara doesn’t keep their large trolley suitcases on Blinkit. Probably because of dark store space constraints and low product velocity. However, what Mokobara keeps at Blinkit are quick-checkout items that users might buy right before their trips, such as fanny packs, slings, and neck pillows.

Go deeper into the selection strategy at BlinkIt here

Pillar #4: D2C to Retail to Global Expansion

Mokobara started online, built a brand, and earned loyalty before touching retail. Once the brand became strong and they saw early signs of users asking for their products in offline stores, they opened physical stores. Like their products, their stores also feel thoughtfully designed and product-led.

From Retail, Mokobara has recently moved to UAE. This retail to global extension of the brand brings the best of omnichannel marketing to the users: touch, feel, experience, convert.

This D2C → retail playbook also let them own margins early, learn fast, and then layer in physical retail to build long-term equity.

When to go from D2C to Retail

Mokobara Financial Journey: From Startup to Standout

Mokobara's ascent in the luggage industry is marked by strategic funding and robust revenue growth, underscoring its potential in the market.

Funding Milestones

Since its inception in 2020, Mokobara has successfully secured approximately $24.1 million across five funding rounds:

Seed Round (March 2020): Initiated with a $313,000 investment from Sauce.vc and Ashish Goel.

Seed Round (March 2021): Raised $1.64 million from Desai Ventures, Sauce.vc, and 18 other investors

Series A (March 2022): Secured $6.5 million with contributions from Saama Capital, Sauce.vc, and 33 additional investors

Series A (August 2023): Obtained $3.6 million from Saama Capital, Sauce.vc, and 25 other investors.

Series B (February 2024): Achieved a $12 million infusion led by Peak XV Partners, with participation from Sauce.vc, Saama Capital, and Aditya Birla Ventures, valuing the company at $80 million post-money.

Revenue Growth

Mokobara's financial performance reflects its growing market presence:

FY22: Reported revenue of ₹12 crore

FY23: Revenue increased to ₹53.3 crore

FY24: Revenue surged to ₹119 crore, a 120% year-over-year growth

This trajectory underscores Mokobara's effective market strategies and product appeal.

While focusing on growth, Mokobara has also improved its financial efficiency. Net losses decreased from ₹8.22 crore in FY23 to ₹4.24 crore in FY24.

The substantial investments from prominent backers like Peak XV Partners, Sauce.vc, and Saama Capital reflect strong confidence in Mokobara's vision and execution. With plans to expand retail operations and enter international markets, Mokobara is well-positioned for sustained growth

That’s it on Mokobara from me 😬

After reading this edition, if you feel like this guy 👇👇, consider subscribing.

PS: Other random, interesting highlights of my last week

A reel I laughed a lot on: here

A thought I thoroughly discussed with my wife and office colleagues: They say, the person who experiences the consequences should make the decision. Do we implement this at work?

Something new I found this week: This whale cleaning video is fooling people (it surely fooled me)

Until next time! 👋

Saurabh

Reply