- The Growth Loop

- Posts

- How Rapido Grows 🪴

How Rapido Grows 🪴

How Rapido is out-executing Ola and lessons on making the most of second-mover's advantage

For the longest time, the ride-hailing aggregator space has been on my writing list. There’s so much to cover, I always felt pressed for time. But recently, a news article caught my interest.

Right after I read this article, Google flooded my feed with items in the same space. I hate it when algorithms do this. Nevertheless, I thought, maybe it’s time I got to it. So here I am, diving into what’s brewing in the ride-hailing space with key-lighting on Rapido - the startup quietly chipping away at the long-standing Ola-Uber duopoly.

As the article suggests, Ola’s valuation just hit a new decade low. Now, I don’t normally talk about valuations because they resemble fictional characters. A lot like Ant-Man. They blow up, shrink down, or stay exactly where they are. None of it is a core signal of the startup’s permanent value.

But this time, I’m starting with it. Because this time, there’s a convincing complementary statistic.

While Vanguard has been valuing Ola down periodically, Rapido’s valuation has been seeing an opposite trend. They raised $200 million in September with a rising valuation of $1.1 billion. One’s on a slide. The other’s climbing. The trend is unmissable.

So what’s going on here? How is a late-boomer stealing market share from the two ride-hailing giants in India?

Let’s break it down.

Here’s what we will be unpacking in today’s Rapido deep dive:

Table of Contents

Rapido’s Origin Story

The story starts in 2012, when Pavan Guntupalli graduated from IIT Kharagpur with a degree in electronics and communication engineering and joined Samsung Research. But the corporate path didn’t stick. By 2014, Pavan left his job to launch a tech-enabled B2B logistics platform called theKarrier, alongside friends Aravind Sanka and Rishikesh SR.

The idea was simple: organize India’s fragmented last-mile logistics sector using a pay-per-kilometer model for mini trucks. The trio raised ₹1.5 crore to scale the business in Bengaluru. But while the model was stable, it hit a ceiling. The B2B space was slower, had long sales cycles, and couldn’t scale the way they imagined a startup should. I talked about this in the Atomberg deep dive also. Like Rapido, they also got some early success doing B2B but then grew rapidly after moving to B2C.

Aravind and team noticed something the ride-hailing giants weren’t paying attention to: two-wheelers. Around the same time, Ola had raised fresh funds and hit a unicorn status, and Uber, in a press release, committed to spending a billion to grow their indian business. But both Ola and Uber were focused on four-wheelers.

So they pivoted.

In 2015, Rapido was born: a bike-taxi platform optimized for affordability, speed, and agility. They started with Bengaluru and Hyderabad, same as the theKarrier. But building this new category wasn’t easy. Rapido faced significant challenges in raising capital. The founders were rejected by more than 75 investors. Commuters hopping on a stranger’s bike felt strange and unsafe. Plus, Ola and Uber had already spent millions on customer acquisition, and it was faster and easier for them to add bike fleets. Burning cash on acquisition with a low AOV (bike rides are cheaper) in a new model wasn’t lucrative enough for many investors, perhaps.

Everything changed when Pawan Munjal, Chairman and CEO of Hero MotoCorp, came on board and joined as an investor in Rapido. Munjal invested personally and advised the team to go deep into Tier 2 and Tier 3 cities, areas often ignored by the incumbents but ripe for disruption.

That shift in focus changed everything.

They avoided direct competition in tier 1 cities from their rivals and scaled rapidly in tier 2 and tier 3 cities.

Rapido Founders: Pavan Guntapalli, Aravind Sanka, and Rishikesh SR

Rapido’s Early GTM

Rapido is a marketplace. And if you’ve been following my deep dives for a while, you would recall that marketplace businesses are some of the most difficult businesses to crack because of the complexity of fragmented supply and evolving demand. (Read about Marketplaces’ evolution, complexity, and how to win them here)

It’s a balance between onboarding supply and generating demand. If the balance dwindles because you are unable to attract enough suppliers, or if you bring in a large number of suppliers without sufficient platform traction, you may find yourself in a challenging situation.

So, the way to approach a marketplace is to identify which side is the hardest (aka most valuable), and grow that side first.

For Rapido, the answer to this was simple: Build supply first. Because booking rides on apps was fairly mainstream by the time Rapido started. All thanks to Ola and Uber.

So let’s look at their supply-side strategy first, followed by their demand strategy.

Rapido’s Early Supply-side Strategy

If you zoom out, most of Rapido’s early supply strategies look familiar. Feet on the street, guaranteed earnings, referrals, and early payouts, all part of the Ola-Uber playbook from their Tier 1 days.

But the real play wasn’t in what Rapido did. It was where and how fast they did it.

While Ola and Uber stayed metro-focused, Rapido sprinted into Tier 2 and Tier 3 cities—places where two-wheelers were everywhere, but app-based mobility barely existed. And being the first bike on the road mattered.

So let’s look at those strategies from Rapido’s lens 🔍

#1. Hyperlocal Captain Onboarding + Dual Earning Pitch

Rapido kickstarted its supply with classic feet-on-street onboarding ops. They deployed local teams to identify densely packed city zones where bike-riding freelancers already moved; outside top-selling restaurants, near food aggregator dark stores, factories, railway stations, petrol pumps, and tea stalls.

Their pitch to the drivers was:

Already riding a bike all day? Make ₹200–₹300 more while you’re at it.

The pitch offered a dual-earning proposition. Ride for Rapido during office rush, deliver food during lunch hours, and chill in the afternoons.

This worked wonders in getting the initial traction. And from there, Rapido turned that traction into a flywheel.

#2. The Referral Flywheel

Once they had an early supply, Rapido leaned into the referrals flywheel.

They built city-wide referral programs where existing riders (Rapido calls them captains) earned bonuses for every new captain who completed a threshold number of rides. But more than the money, the system created micro-networks of trust. If your friend onboarded you, you stuck around. You took it seriously. You learned the tricks faster.

Rapido's Referral Flywheel

This created dense, hyperlocal webs of captains who:

Helped each other optimize earnings

Shared tips through WhatsApp groups

Gave Rapido access to cluster-wise growth

#3. Quicker Onboarding (with Risks)

While Ola and Uber were still verifying new users with physical KYC in the early days, Rapido entered the market at a more digitally mature moment. That meant they could lean into fully digital onboarding. KYC, Driver’s Licence verification, Insurance, vehicle registration- all frictionless

But it wasn’t without risk. Fraud, fake numbers, and duplicate accounts were early headaches. Still, the bet was clear: make the barrier to trying Rapido as low as possible.

#4. Trust-building tools

Fuel costs 50%-60% of the overall cost in the ride-hailing business. Hence, this is the first worry that Rapido took off the captain’s head. In the initial days, they offered Instant Payouts and guaranteed earnings if logged in for more than X # of hours a day.

Rapido further incentivized the captains by setting lower weekly targets and hosting get-togethers to celebrate the winners.

#5. Voice Prompts and Vernacular UI

To make the platform more accessible for captains across India, Rapido also integrated vernacular language support and voice-guided app navigation. This removed the barrier to entry for riders unfamiliar with smartphones and gig platforms. Moreover, they also optimized their rider’s app for lower-end Android devices, doubling down on trust and convenience.

With supply density locked in and captains zipping through cities, Rapido had built the rails. Now it needed customers. And just like on the supply side, it didn’t try to reinvent the wheel, but it did know which lanes to skip.

I spent 15 hours creating this deep dive. If you’ve learnt something so far, consider subscribing. I post every Friday.

Rapido’s Early Demand-side Strategy

Once Rapido had built enough captain density, it was time to get the riders on the app. Price-sensitivity is highest amongst the early 20s and 30s. So, Rapido’s demand playbook focused on reeling in these users first. Let’s look at how their penetration pricing, promotions, campaigns, and strategic partnerships helped them go from 3k rides/day in 2017 to 1M+ rides/day in 2019

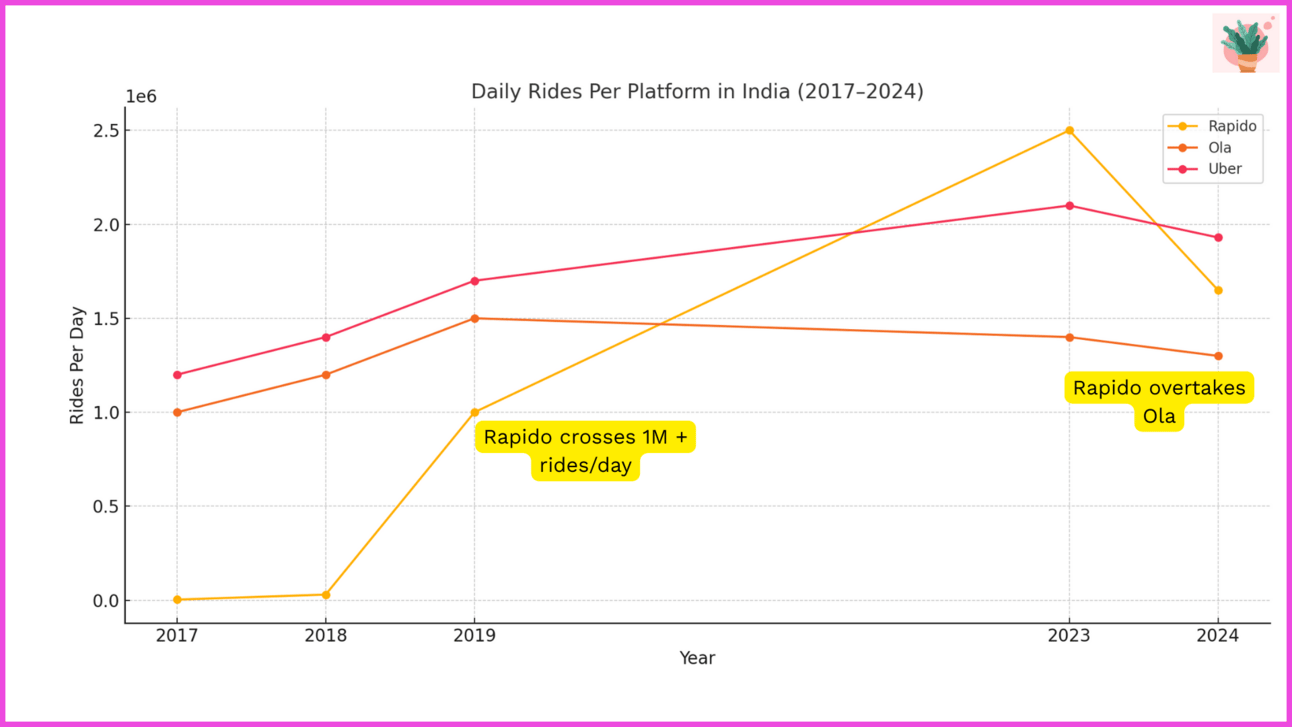

Estimated number of daily rides from Rapido, Ola, and Uber from multiple sources such as Outlook and Business Standard

#1. Penetration pricing for new users

In Tier 2 cities, ₹10-₹15 price differences matter. For new users, Rapido made it a stupid-easy choice by floating “discounts” that took the prices similar to shared autos and public transport. After a few rides, you could again refer friends and continue at the same rate. While this helped in getting new customers, it also kept the customer acquisition cost(CAC) in control.

Rapido's First Ride Discount

#2. Promotions with a local edge

Referrals were baked into the experience early on. But unlike typical metro-style campaigns, Rapido leaned heavily into localized promotions.

Campus Ambassador Programs: Rapido initiated campus ambassador programs in Tier 2 engineering colleges, such as PES University and IIT Kharagpur. These ambassadors organized on-campus events, distributed promotional materials, and facilitated app installations among peers, effectively turning students into brand advocates.

Community WhatsApp Forwards: Rapido circulated community-specific forwards containing UPI cashback links, encouraging users to try the service and share it within their networks.

#3. Strategic Partnerships: Distribution Without Burn

Rapido embedded itself into platforms that its users already trusted and transacted with.

Google Pay and PhonePe: In 2020–21, Rapido ran ride cashback campaigns on Google Pay and PhonePe. Every time you book a Rapido and pay via Google Pay, you get a scratch card, and you earn a reward instantly.

Bonus: Every time you open G-Pay’s reward section, Rapido’s coupon sits there, gaining visibility

Swiggy: In April 2022, Swiggy led a $180 million funding round. So, it made sense to find synergies in their fleets. Since Rapido drivers also moonlight as Swiggy and Zomato delivery partners. Rapido turned this insight into a strategy.

They partnered to send targeted push notifications to Swiggy users for ride discounts, especially near mealtimes and campuses.

Fintech Funnels: Mobikwik, Freecharge, and Paytm wallet: For tier 2 cities, digital wallets and coupon websites still dominate. Rapido is integrated into Mobikwik’s ride cashback ecosystem, often tied to UPI referrals or balance top-ups.

For Example: “Recharge ₹100, get ₹30 off your next Rapido ride.”

Same OTP moment ❤️

My wow moment with Rapido was on the third ride. I noticed that their OTP remained same. No more taking out the phone while you are still settling into the ride. I loved it and told my friends about how small yet amazingly convenient it was.

#4. The Helmet Marketing

Every city that Rapido entered, its most visible asset was their Yellow Helmet.

Each Rapido captain wears a bright, unmistakable branded helmet. It’s part safety, part rolling ad. Unlike Ola/Uber cars that blend into traffic, Rapido’s two-wheelers stand out in a way you can’t not notice

Rapido's Helmet Marketing

#5. Regional influencers

Early on, instead of going on TV ads and bringing celebrities, Rapido partnered with regional creators who genuinely mirrored their rider base.

In Tamil Nadu, they worked with YouTubers who spoofed real-life commute chaos.

In Telangana, they collaborated with Hyderabadi meme pages like @hyderabadi.memes_ and comic sketch channels. The content is blended with humor and gets the attention of the youth.

#6. Notable Campaigns

Bike wali Taxi, Sabse Saxi: A campaign that showed how Rapido users are cutting the bus wali jhik jhik by choosing Rapido

5 nahi toh 50: We all know the pain of waiting for autos and cabs. When Rapido started autos (I’m coming to this in a minute), they launched a campaign that targeted this use case head-on with a bold promise.

You get an auto within 5 minutes of booking. If you couldn’t find one, Rapido rewards you with 50 coins.

From Bikes to Autos to Cabs

Once Rapido nailed bikes in Tier 2 and 3 cities, they moved up the order value ladder to cabs and autos. Unlike bikes, there was no need for market creation.

People were already hailing autos. So Rapido did large-scale awareness campaigns (Like this) and just stepped in with better economics.

Following the Zero Commission Model of Namma Yatri

Aggregator commissions is a forever-burning topic for ride-hailing apps. That’s also the prime reason riders have moved to Namma Yatri in Bengaluru. Inspired by it, Rapido took the same Zero-commission model to cabs first and then brought it to autos.

Today, cab drivers on the Rapido platform need to pay a subscription fee of Rs 500 if the earnings exceed Rs 10,000. For auto rides, the daily fees is in the range of Rs 5 and Rs 29.

"It is a groundbreaking approach that guarantees that captains bear only a nominal access fee, rather than a commission per ride. This marks a noteworthy change in the industry, bringing in a more enabling revenue model for our captains."

Out-executing Competitors

Now, if you have been following ride-hailing aggregators for a while, you might say the playbook looks similar to Ola’s in their hyper-growth phase. Then, what’s really driving Rapido’s growth and Ola’s decline?

I’ve got some theories on that.

Focus

You see, Ola is an opportunistic company. Food delivery is on the rise; they started doing food deliveries (later bought foodpanda also). 10-minute delivery is the flavour of the year; Ola started doing 10-min deliveries with ONDC. AI is booming; Ola came up with Krutim AI. EVs are the next big sector; we all know how it’s going. In comparison, Rapido has a straightforward ride-hailing business. An easier mental model.

Innovator’s Dilemma

The book Innovator’s Dilemma by Harvard Professor Clayton Christensen has an interesting thesis. Incumbent companies often ignore emerging technologies because they initially seem too weak or unprofitable. These new entrants usually start by targeting the lower end of the market. Over time, as the technology improves, these disruptors move up the value chain, eventually overtaking the giants who once dominated.

What’s interesting is, everyone makes a rational decision. Incumbents are protecting their high-margin customers and ceding the “less valuable” ones. But that’s how they get stuck on the top.

Rapido started from the bike rides (least profitable customers). Uber and Ola also started it, but eventually dropped it due to regulatory constraints and lower margins. Today, as Rapido moves to its profitable sectors and customers, Uber is forced to differentiate by going premium (Uber Black).

In cabs, the zero-commission model moved their supply to Rapido, forcing Uber to change their stance and operate on the same model.

And if you look at it holistically, it’s not just Rapido’s entry into cabs and autos leading to lower rides at Uber and Ola. There’s a second aspect: EV players like Shoffr (recently funded). These guys are focused on taking away their most profitable customers (the airport rides in Bengaluru and Hyderabad) from Ola and Uber. A battle at both ends

Timing

The last, I think, maybe it’s timing. Rapido did not have to make the market. They entered late when the user habits and infrastructure were well built, and that’s exactly what made them interesting to later rounds of investors.

It’s a classic second-mover advantage.

From an investor lens, backing someone who’s entering an existing market with momentum feels like a safer bet. That’s why, while Zepto was a front-runner in 10-minute deliveries, Swiggy’s Instamart also had enough investors, even though it started late.

The same applies to Rapido.

I think it’s a combination of focus, classic innovator’s dilemma, and timing that has turned a more than a decade-old ride-hailing business in Rapido’s favour.

PS: Other random, interesting highlights of my last week

An ad I laughed a lot at: here

A thought I thoroughly discussed with my wife and office colleagues: Why is it so much fun to watch narcissistic people go down?

Something new I learned this week: How to make a decent product shoot with GPT

Until next time!

Saurabh 👋

Reply